What is EBITDA?

EBITDA stands for:

Earnings

Before

Interest

Taxes

Depreciation

Amortization

Its a financial indicator that illustrates a companys earnings before deducting specific costs.

What makes EBITDA crucial for businesses?

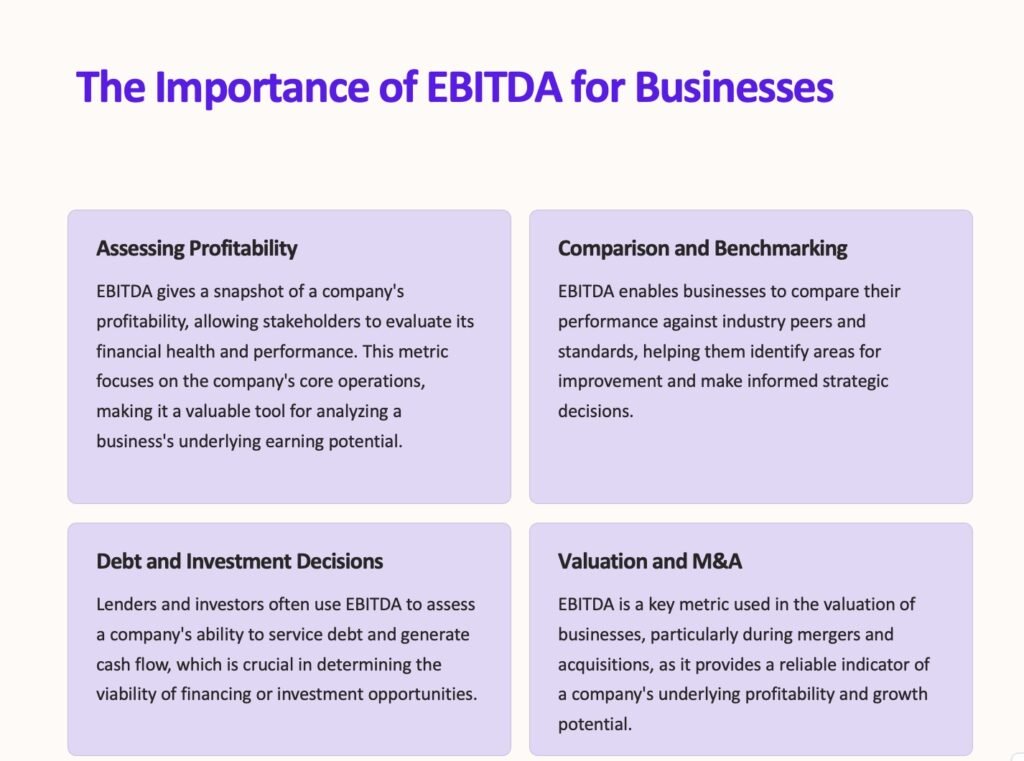

EBITDA is crucial because it provides a sense of how much revenue a business is making from its activities. Knowing a companys profitability is helpful for lenders and investors. Knowing how much money a company is making is similar to having a scorecard.

How does one calculate EBITDA?

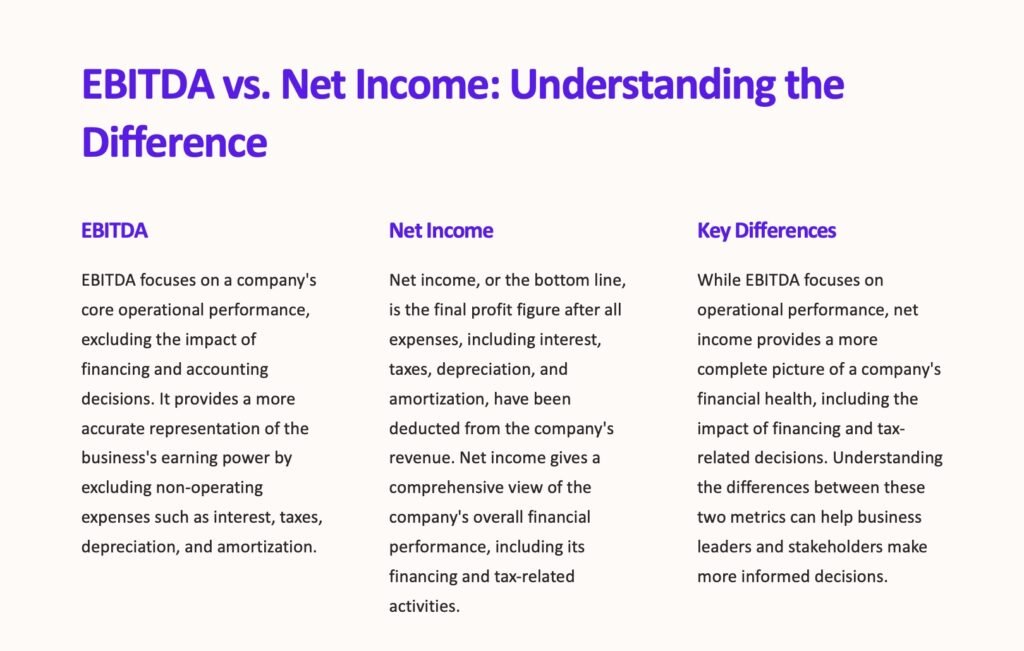

The revenue of a business must be subtracted from its cost of goods sold in order to get EBITDA. Its running costs such as rent and salaries are then subtracted. You can see the companys EBITDA here. An illustration would be:. Assume that you and your pals operate a lemonade stand. You spend $5 on lemons sugar and cups but you make $20 selling lemonade. Flyers to promote your lemonade stand cost you an additional $5. You would take the $20 you made from selling lemonade and deduct the $5 you spent on cups sugar and lemons to get your EBITDA. After this you have $15. The $5 you spent on advertising would then be deducted. After this your EBITDA is $10. Net income versus EBITDA. Lets say that in addition to the costs associated with operating your lemonade stand you also need to pay taxes in order to participate in street sales. Additionally consider the scenario where your machine is getting too old and you need to save up money to buy a new one or a new stand. Our term for this is depreciation. These costs are not included in EBITDA.